The landscape of venture capital investment in China is undergoing a transformation as Silicon Valley investors are distancing themselves from Chinese start-ups. According to a report from The New York Times, top firms are reducing their investments in Chinese companies amidst increased scrutiny from U.S. lawmakers. This shift signifies a significant departure from the once-thriving relationship between Silicon Valley and the Chinese start-up scene.

A notable example of this shift is apparent in the case of DCM Ventures, a prominent Silicon Valley venture capital firm. DCM Ventures initially began investing in Chinese start-ups in 1999, with plans to “double down” on this strategy in 2021. However, recent developments paint a different picture. Last fall, when DCM sought to raise funds for a new investment venture, the firm conspicuously omitted any mention of China from its promotional materials. Instead, the focus was placed on investments in the United States, Japan, and South Korea. This deliberate omission underscores a broader trend among U.S. venture capital firms that are increasingly cautious about their involvement with Chinese start-ups.

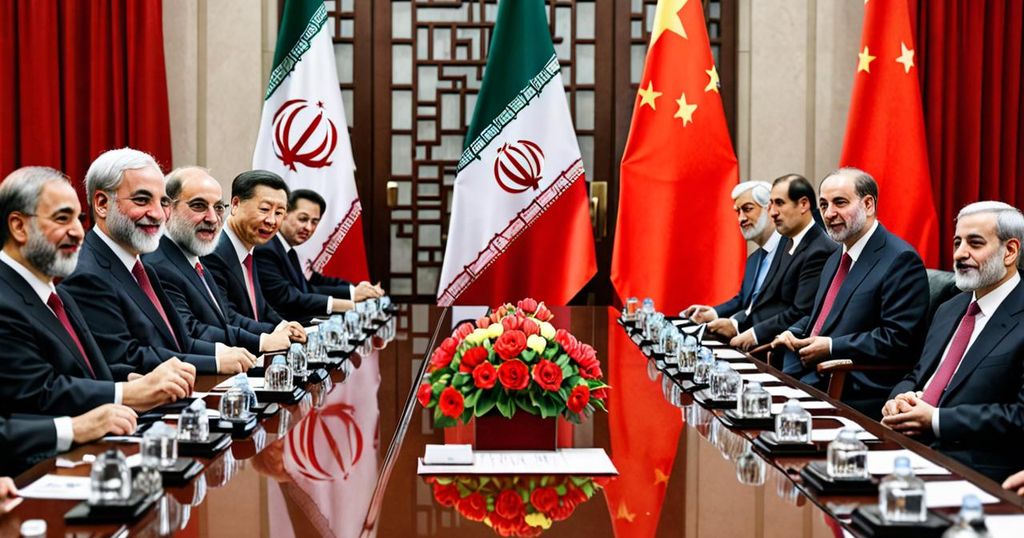

The strained relationship between the United States and China has played a significant role in this shift. As the two global powers continue to navigate diplomatic tensions and trade disputes, U.S. venture capital firms are reassessing their investments in China. In response to these geopolitical and economic challenges, some firms have chosen to separate their Chinese operations from their main business, while others are opting to forego new investments in China altogether.

Tomasz Tunguz, an investor at Theory Ventures, characterized the evolving landscape as a departure from the once-lucrative partnership between U.S. venture firms and China. He noted that the current market conditions have led most investors to explore alternative investment opportunities outside of China.

In light of these developments, a spokeswoman for DCM Ventures affirmed that the firm’s investment strategy remains unchanged. She emphasized that investments in China have always represented a smaller portion of their funds, particularly those focused on very young companies. Additionally, she acknowledged that the firm is closely monitoring U.S. regulations concerning investments in China to ensure compliance.

As Silicon Valley continues to reassess its investment strategies in light of geopolitical and regulatory challenges, the future of U.S.-China venture capital relations remains uncertain. The evolving dynamics between these two economic powerhouses will undoubtedly shape the trajectory of the global tech and start-up landscape in the years to come.

In conclusion, the changing relationship between Silicon Valley and China reflects a broader recalibration of global investment dynamics. As U.S. venture capital firms navigate heightened regulatory and geopolitical challenges, their approach to investing in Chinese start-ups is evolving. Amidst these shifts, the implications for the global tech and start-up ecosystems are substantial, highlighting the interconnectedness of the global venture capital landscape.