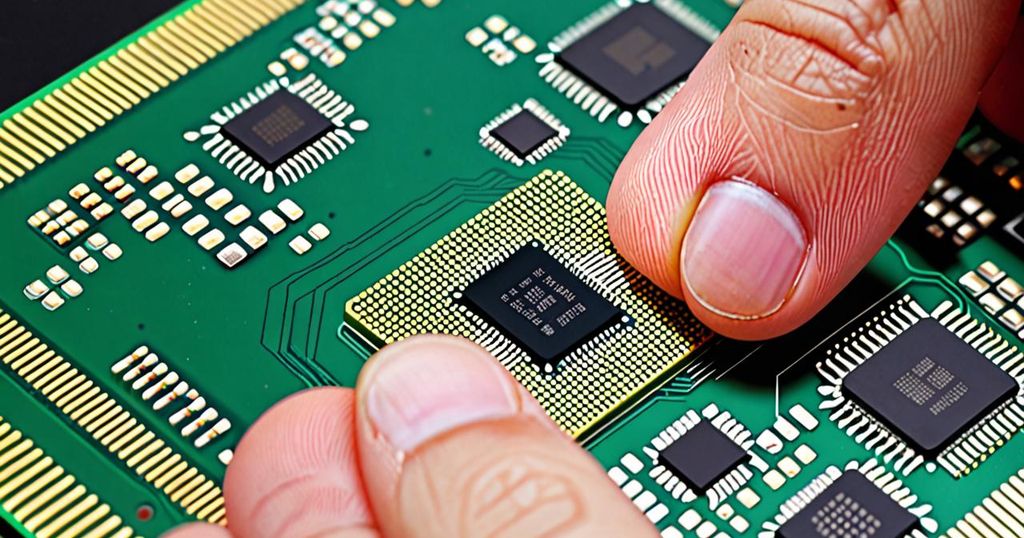

China has embarked on a significant initiative to decrease its reliance on foreign chip technology, a development that has largely flown under the radar. Major companies such as Huawei have been diligently working to cultivate their local suppliers, and it appears that they are making substantial headway.

While China has previously been recognized for its capacity to replicate cutting-edge foreign technology, it has encountered obstacles in the realm of semiconductors. The recent cessation of exports of high-tech chips and chipmaking tools to China by the US in 2022 served as a wakeup call for the country, underscoring the extent of its dependence on foreign suppliers. This has spurred China’s determination to elevate its domestic chip industry, with the objective of supplanting foreign suppliers with local ones.

To accomplish this objective, the Chinese government has been making substantial investments in its domestic chip industry for several years, and recent trade constraints imposed by the US and its allies have only served to further intensify their efforts. The “Information Innovation” project, also known as xinchuang, has played a pivotal role in this endeavor, striving to reduce China’s reliance on foreign semiconductor technology. Consequently, this initiative has resulted in a deepening of China’s semiconductor supply chain, as local chipmakers and suppliers are now collaborating more closely than ever before.

Huawei, a prominent Chinese technology company, has also made considerable advancements in the chip industry. Notably, the company has developed a smartphone featuring a seven-nanometre (nm) chip capable of 5G internet speeds, and there are reports that Huawei is on the verge of producing even smaller 5nm chips in conjunction with SMIC, China’s largest foundry. These chips are not only utilized in Huawei’s products but are also finding application in other domains, such as AI models developed by companies like Baidu.

Despite China’s remarkable progress in chip technology, it still trails behind industry leaders like Samsung and TSMC. These companies have already commenced the mass production of 3nm chips, significantly surpassing China’s existing capabilities. China’s scarcity of advanced lithography equipment presents a substantial barrier to its continued advancement in this sphere.

Notwithstanding these challenges, China is steadily diminishing its reliance on foreign semiconductor technology. For instance, Huawei has been actively collaborating with local chip foundries and allocating resources to the development of electronic-design-automation (EDA) software, which has the potential to emancipate China’s industry from the necessity to depend on foreign suppliers for certain semiconductor components.

In a noteworthy shift, Chinese chip foundries, which previously relied on the importation of machinery from abroad, are now exploring domestically produced alternatives. This trend has resulted in an increase in the market share of Chinese producers of chipmaking equipment, with certain companies making substantial strides against their foreign counterparts.

The Chinese government has played a central role in this transformation, investing billions of dollars in subsidies and participating in many of the country’s semiconductor supply chain companies. While this approach may not be as streamlined as reliance on global supply chains, it underscores China’s commitment to attaining self-sufficiency and security in its chip production.

In summation, China’s sustained endeavors to fortify its domestic chip industry and diminish its reliance on foreign technology serve as a testament to the country’s dedication to assuming a leadership role in semiconductor production on the global stage. Despite facing significant hurdles, China is making notable progress in this pivotal industry, and it will be intriguing to observe how its chip industry continues to evolve in the years to come.